Bitcoin

Bitcoin has emerged as possibly the best hedge against the market crash. But what is the use of investing in it if the bitcoin itself is prone to the collapse? What opportunities are left for this highly volatile investment that had already gone through catastrophic fall?

The Recent Surge of Bitcoin Price

BEAR CASE

In December 17, 2017, bitcoin’s price reached all time high at $19,783.06. Five days later, it fell below $11,000, a fall of 45% from its peak. By September 2018, the decline of the Cryptocurrency market became larger than the bursting of the dot-com bubble in 2002.

Recent surge of bitcoin price is merely the repetition of what had occurred before and will meet its demise in the foreseeable future.

BULL CASE

While the Cryptocurrency bubble in 2017 is highly contributed by individual investors, recent rise is due to the tremendous efforts from the institutions(whales).

Source: Glassnode

As per the analysis from Glassnode, more than 95% of bitcoin’s market cap is kept in wallets that hold at least 1 BTC. This represents that more affordable, and rich investors (mostly institutions) are in charge of the bullish trade while less individual, retail investors are actually participating in the race.

Source: ARK Invest

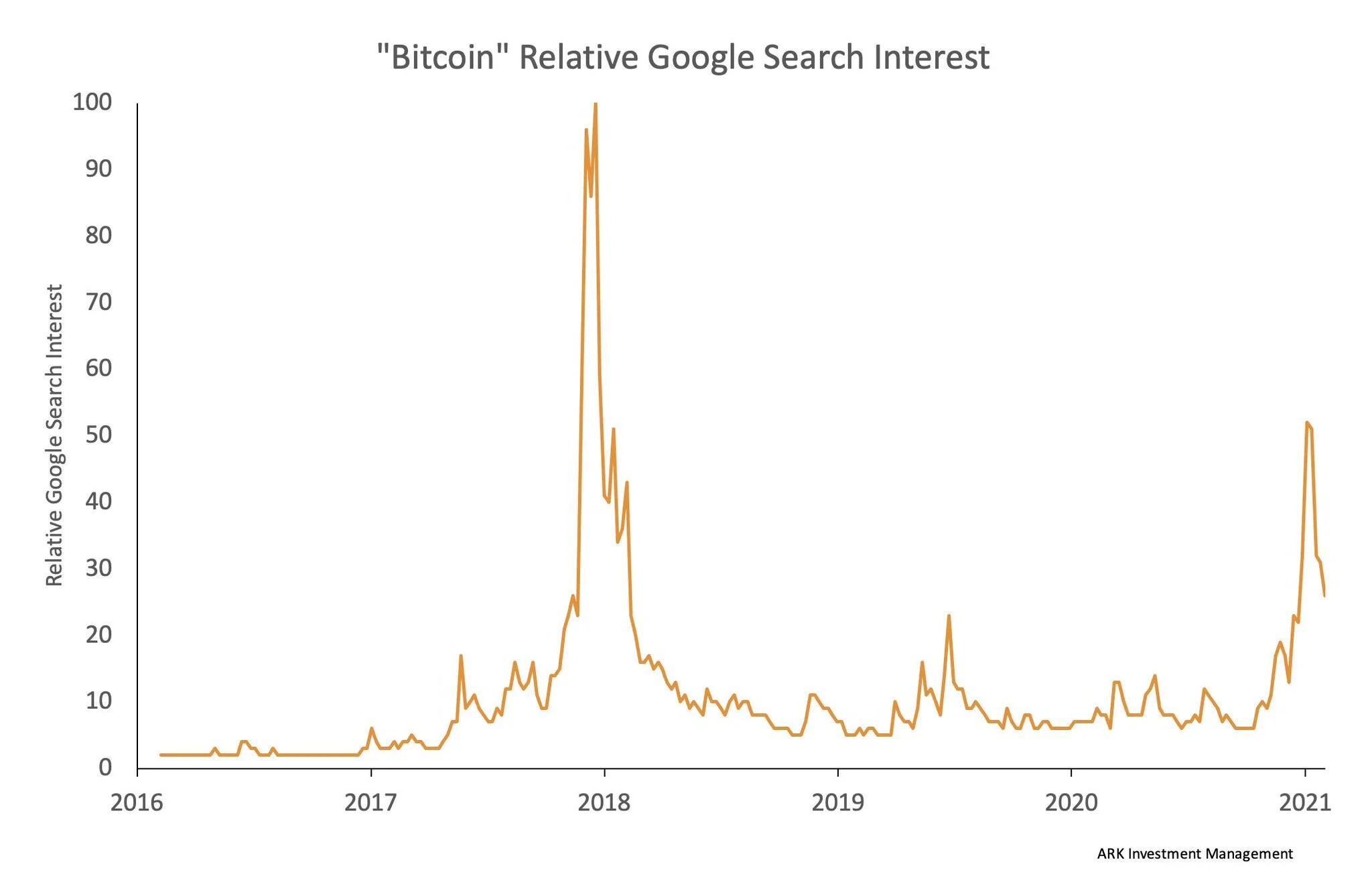

The more interesting insight we can earn is that even though the bitcoin market cap is way higher in 2021 as its highest market price exceeded above $40,000, number of people searching for bitcoin related keywords has relatively shrank, according to the above chart. This shows that the large portion of market buy is done by the institutions, and not the retail investors. The uncertainty in the Cryptocurrency sector is prevalent among retail investors, and it’s reasonable since they all witnessed the 2017 crash. But this can easily be overcame in the upcoming future if more institutions invest in bitcoin. If more and more retail investors settle to take part in the bull run similar to what they did in 2017, there’s a huge probability the bitcoin price will amount to all time high.

Government Regulation

BEAR CASE

As Biden administration sworn in to the White House, Janet Yellen became the Secretary of Treasury, who will make a huge impact on the bitcoin’s future. In her confirmation hearing, Janet Yellen says Cryptocurrencies are a ‘Concern’ in terrorist financing. The report from BitMEX Research disrupted bitcoin’s user base on top of that, suggesting that the double spend issue had occurred in the bitcoin blockchain. These two events became the huge catalyst that made bitcoin fall 11% of its original price. Government regulation being the biggest hurdles for further growth, the credibility of the Cryptocurrencies is highly questioned.

Source: Ray Dalio from Bridgewater

Even though some are neither outright nor full ban, bitcoin traders react sensitively, and there are more potential regulations to come in the upcoming future. Biden government’s vision toward blockchain technology will play a significant role in bitcoin’s future, but please be reminded it’s not off to a great start judging by the nomination of Janet Yellen as a Secretary of Treasury who often appears to have negative view of bitcoin.

Legal map of bitcoin and other Cryptocurrencies / Source: Coin Dance

How about the ban outside the States? Though not many countries are treating Cryptocurrency illegal, in the extreme case, China has even banned Crypto exchanges. Despite there’s a slim chance United States would impose such regulation, reduced inflow due to China’s regulation is already driving down the price of a bitcoin.

Source: Coinmetrics, Ray Dalio from Bridgewater

Trading is global. Still, as seen above, largest shares of inflows and outflows are in USD. With possible government intervention forthcoming, it might not be worth investing in this uncharted territory.

BULL CASE

The ‘double spend’ has never happened in the first place. While the same coins from the same wallet were registered in two different blocks, no new coins were added to supply.

Janet Yellen was on a policy watch as a Fed Chair in 2017, quoting bitcoin as a ‘highly speculative asset’. At the same time, the bitcoin soared from roughly $1,000 to $20,000, but no particular regulation has been implemented. Furthermore, bullish investors see her call on bitcoin on the day of her hearing as more like a ‘cliche’, which focused on the risk of potential crimes with bitcoin as a vehicle, rather than the risk to U.S. monetary sovereignty. In fact, according to the ARK Invest analysis, crimes facilitated by USD cash are more frequent than the equivalent using Cryptocurrency.

Janet Yellen also stated “we need to look closely at how to encourage their use for legitimate activities while curtailing their use for malign and illegal activities” and can “improve the efficiency of the financial system”, which gives the slight hint that she will keep an eye on the trade flow closely monitoring potential illegal use of bitcoin while not outright prohibiting the use of it.

Emergence as ‘Digital Gold’

BEAR CASE

By owning a gold, you are rewarded with the physical, tangible asset. bitcoin can never be the substitute for the gold, since its value is solely built by the mutual trust. It’s matter of time this unfounded trust leads to the inevitable fall, evidenced from the recent crashes, one of which swept out all the profits made in 2021.

Let’s consider the differences between these assets in terms of scarcity and fungibility. We get that bitcoin is highly favored due to ease of sending and receiving it, while gold is the directly opposite. We should also remind that gold is under government’s control, making it easy to confiscate. And this aspect gives an advantage of gold being the low risk, lowly volatile, super safe asset. On the other hand, bitcoin has high risk & high return and obviously this brutal double-edged sword induces crippling anxiety and causes insomnia to a number of investors endlessly checking the market in fear that never closes.

BULL CASE

It’s true that bitcoin gives no physical value in return, and there’s no denying that the credibility among the investors is the everything that results in bitcoin’s current market cap exceeding 600 billion U.S. It’s apparent that gold and bitcoin share very few common traits. But here’s why bitcoin can succeed to gold in completely different form.

The investments, in general, are speculative in nature. And the most traders are always future-oriented. Investor’s valuation of the specific stock or asset won’t be tore down easily because of its current state and performance. If you value the asset’s future landscape highly, it’s highly likely that you will invest in it. This process creates a virtuous circle creating consistent demands and that’s the very force that drives the market trade to function.

It’s already well known that both bitcoin and gold are globally accepted and limited in supply. But it’s impossible to measure the quantity of gold that’s left under the earth. But the prominent difference here is that the bitcoin’s supply is fixed. The max amount of bitcoin that can be mined equals to 21 millions. Currently, around 18.5 million bitcoins have been mined, and the scarcity will dramatically increase as it reaches to the end. It’s also important to point out that bitcoin rewards every four years until the very last bitcoin has been mined. For instance, when bitcoin first launched, the reward was 50 bitcoin. In 2012, it halved to 25. In 2016, it halved again to 12.5. This massively decreases the amount of rewards mined each time for many years to come, greatly increasing the scarcity. The lesser the supply, more valuable the asset becomes.

More and more institutions are betting on bitcoin as an ‘insurance’. Like gold, bitcoin will have safe heaven properties in economic collapses. Since bitcoin is highly volatile asset, it'll play a significant role as a hedge against the market crash. Why not put Cryptocurrency into 5% of the stock portfolio that can cover a huge scale of potential damage that can be caused from the rest 95%? bitcoin is not correlated to the stock market, making it a great insurance that can prevent the worst case scenario in the stock market.

Lesson from the GameStop Short Squeeze

r/wsb on Reddit was at the forefront of the battle against the hedge funds blamed for betting against the GameStop stock. This historical event shows that retail investors, if teamed up, can drastically change the paradigm of the market. Citron Research covered the put options with great loss and Melvin Capital lost roughly half of their entire asset (at least that’s what mainstream media ‘advertises’, which stirred up the WallStreetBets army suspecting that it’s the sneaky tactic luring investors to sell their positions). Stock trading app Robinhood’s decision to restrict users from buying certain stocks (they removed the ‘buy’ button!) is the most ridiculous among all the frenzy behaviors that tried to discourage retail investors. Unlike its name, Robinhood’s deep relation with the Citadel arouse the ire of users, causing users to migrate to more secure and transparent trading brokers.

Such example shows that the system is rigged in the first place and the Wall Street won’t hesitate to disturb the market by changing its very own rule. Though this became the excellent exemplar how retail investors can hugely profit from the gigantic hedge funds, they also realized that the malicious act from the corporate giants is always ready to intervene.

After this incident, many sees that the no correlation between the U.S. stock market and the bitcoin will give more benefit to bitcoin rise as more investors weigh more interest into the credible and secure investing environment. Coincidence or not, the bitcoin surged after this incident, especially propelled by Elon Musk who also holds negative view toward hedge funds betting against the certain stock like GameStop.

Pollution

(TBD)

Public Figures

DOUBTER

Bill Gates

According to Bill Gates, Cryptocurrencies are the anonymous form of currencies. He also said that the chances of tax evasion, money laundering, terrorist funding could be increased due to the maximum usage of the Cryptocurrency.

In an CNBC interview on Feb 18, 2021, Bill Gates said he don’t own bitcoin, but remains neutral about crypto asset. His view in cryptocurrency changed from ‘crazier, speculative’ into ‘neutral’ after bitcoin has soared above 50k USD.

Warren Buffet

Berkshire Hathaway CEO has repeatedly criticized bitcoin and other Cryptocurrencies as risky and worthless.

BELIEVER

Elon Musk

“I think bitcoin is really on the verge of getting broad acceptance by conventional finance people.”

SEC filing shows that Tesla purchased $1.5 billion in bitcoin.

Chamath Palihapitiya

Cathie Wood

Founder, CEO, and CIO of Ark Investment set her bitcoin price target to $400,000. She is very well known for being the extremely bullish trader, and for beating the Wall Street and highly profiting from the Tesla bet.

Final Verdict

Bullish

Purchase date: Jan 4, 2020Average cost: $30,616.57